How to Apply for public money receiving account Registration on Your Income Tax Return

- Last Updated:

From January 2022 (2021 income tax return), a deposit account that was applied for as an account to receive a refund, etc. in the procedures for filing an income tax return (return for refund) or requesting a correction can be registered as a public money receiving account account (or changed if already registered).

You can file your tax return electronically through the Electronic National Tax Return Filing and Payment System (e-Tax) or in writing at a tax office counter. For income tax returns for 2021, you can only file your tax return electronically by logging in to e-Tax in My Number Card.

Table of Contents

- How to Register

- Example of entry at the tax return preparation corner when wishing to register as a public money receiving account

- Example of Filling Out a Declaration Form in the Case of Wishing to Register a public money receiving account Site

How to Register

If you wish to register the account to receive the refund as public money receiving account, please specify the account to which the refund will be transferred and respond that you agree with the registration of public money receiving account. For details of the procedure, please refer to the form and guide for the final return form for the year subject to the final return.

Public money receiving account registration results will be notified to you by Mynaportal (notification), e-Tax message box, mail (post card) from Digital Agency, or multiple methods.

Please note that your application will be rejected if any of the following apply.

- If the financial institution of the account to receive the refund is not a financial institution that can be registered as a public money receiving account

- If it is not possible to confirm the existence of the deposit account that was applied to receive the refund.

- When an application is made for the same deposit account that has already been registered as a public money receiving account

In addition, in the following cases, information will not be transferred from National Tax Agency to Digital Agency, and the application itself will not be made.

- If there is any deficiency in the contents of the declaration

- Incorrect My Number (Individual Number)

- Failure to make a identity verification

- KANA Where the name is not stated

- When an account at a non-existent financial institution or branch is specified

- If the account type of the account to receive the refund is not an account type that can be registered as a public money receiving account (ordinary / current)

Example of entry at the tax return preparation corner when wishing to register as a public money receiving account

Depending on the year in which the final tax return is filed, the names of items and screen layouts may differ from those shown below. Please enter the account information to be specified for the method of receiving a refund after confirming that the account information in the name of the applicant is correct using a passbook, cash card, smartphone application, etc.

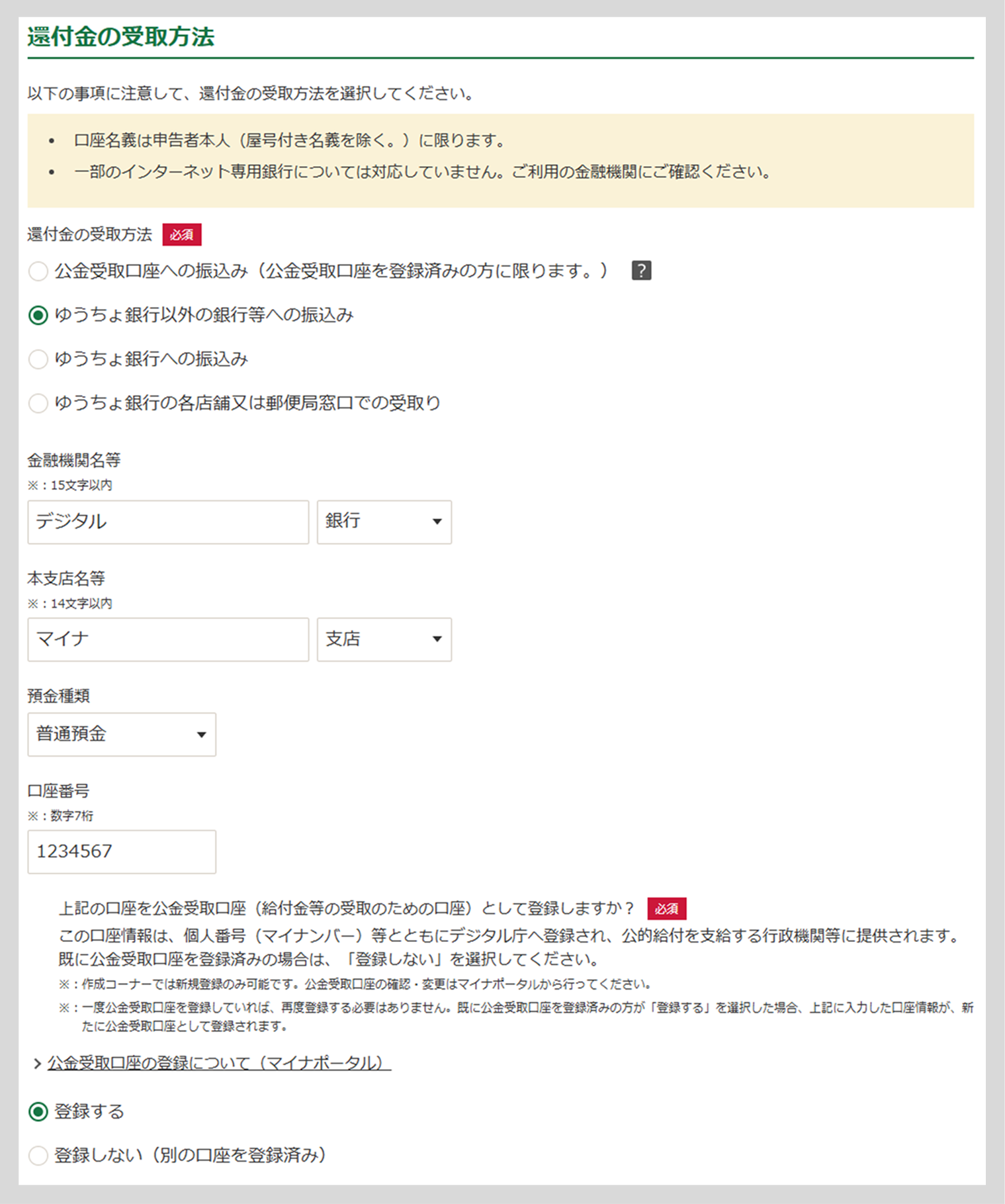

Financial institutions other than Japan Post Bank

- Select "Transfer to a bank other than Japan Post Bank, etc."

- Name of financial institution, etc.: (e.g., digital bank)

- Name of branch: (Example) Minor Branch

- Deposit Type: Select the type of deposit for the account you wish to register (e.g. ordinary deposit)

- Account Number: (Example) 1234567

- Public money receiving account Registration Agreement: Select "Register"

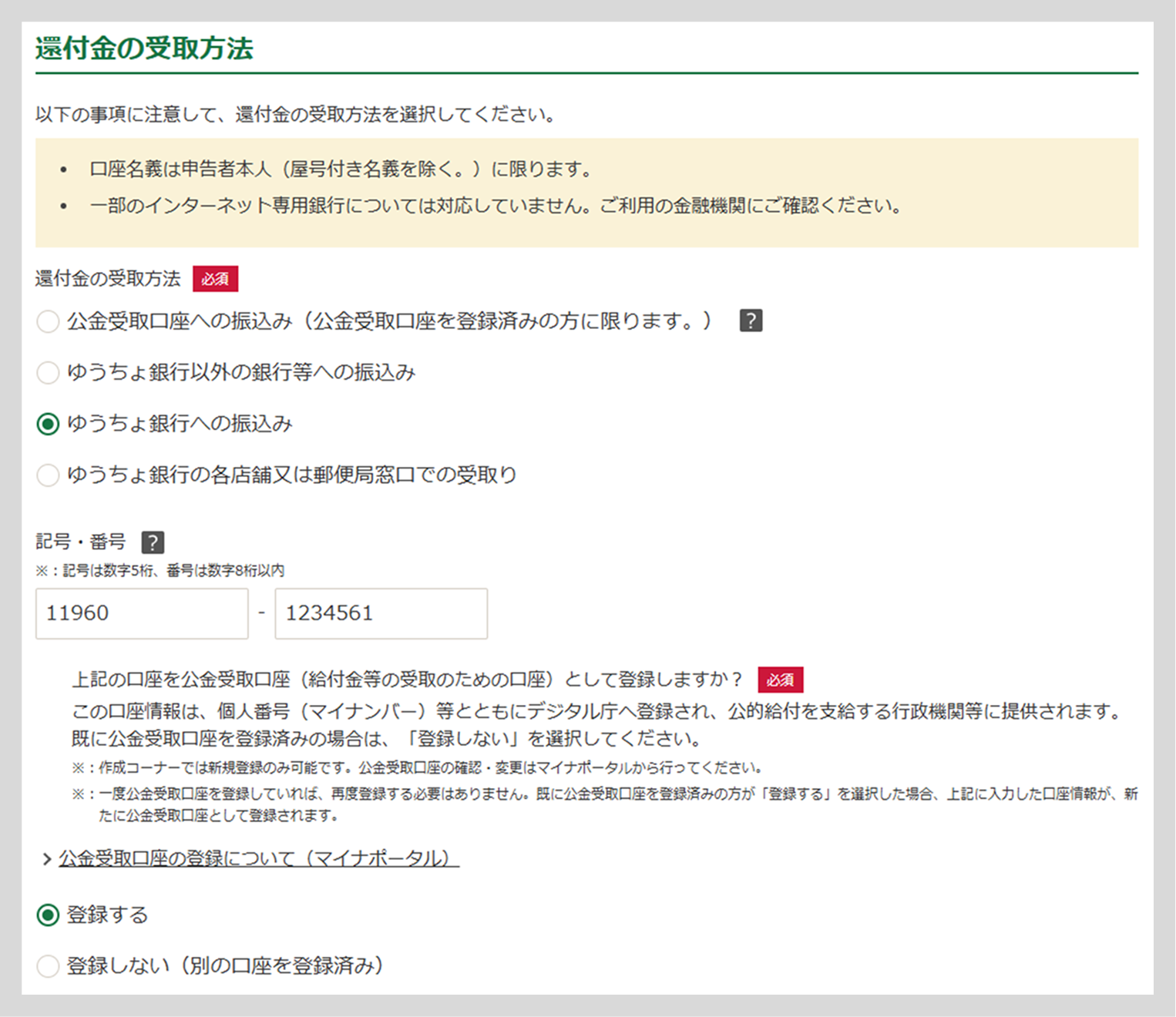

In the case of Japan Post Bank

- How to receive a refund: Select "Transfer to Japan Post Bank"

- Symbols and Numbers: (Example) 11960-1234561 (one digit is not necessary between the symbols and numbers)

- Public money receiving account Registration Agreement: Select "Register"

Example of Filling Out a Declaration Form in the Case of Wishing to Register a public money receiving account Site

Depending on the year in which the final tax return is filed, the names of items and the form of the return may differ from the following. Enter the account information to be designated as the place to receive the refunded tax after confirming that the account information in the name of the taxpayer is correct on his / her bankbook, cash card, smartphone application, etc.

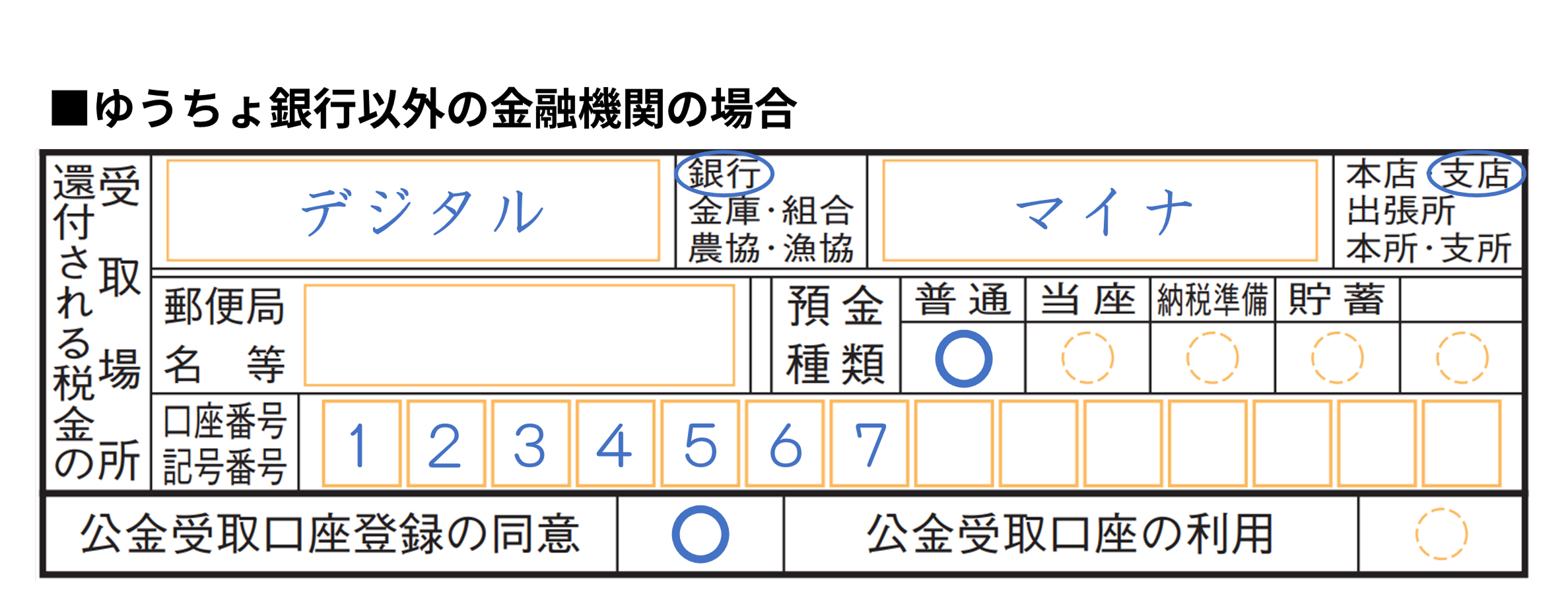

Financial institutions other than Japan Post Bank

- Name of Financial Institution: (Example) Digital Bank

- Store name: (Example) Minor branch

- Name of post office, etc.: (Leave blank)

- Deposit Type: Enter a circle (○) in the deposit type of the account you wish to register (e.g. "Ordinary")

- Account Number: (Example) 1234567 (left aligned)

- Use of public money receiving account: (leave blank)

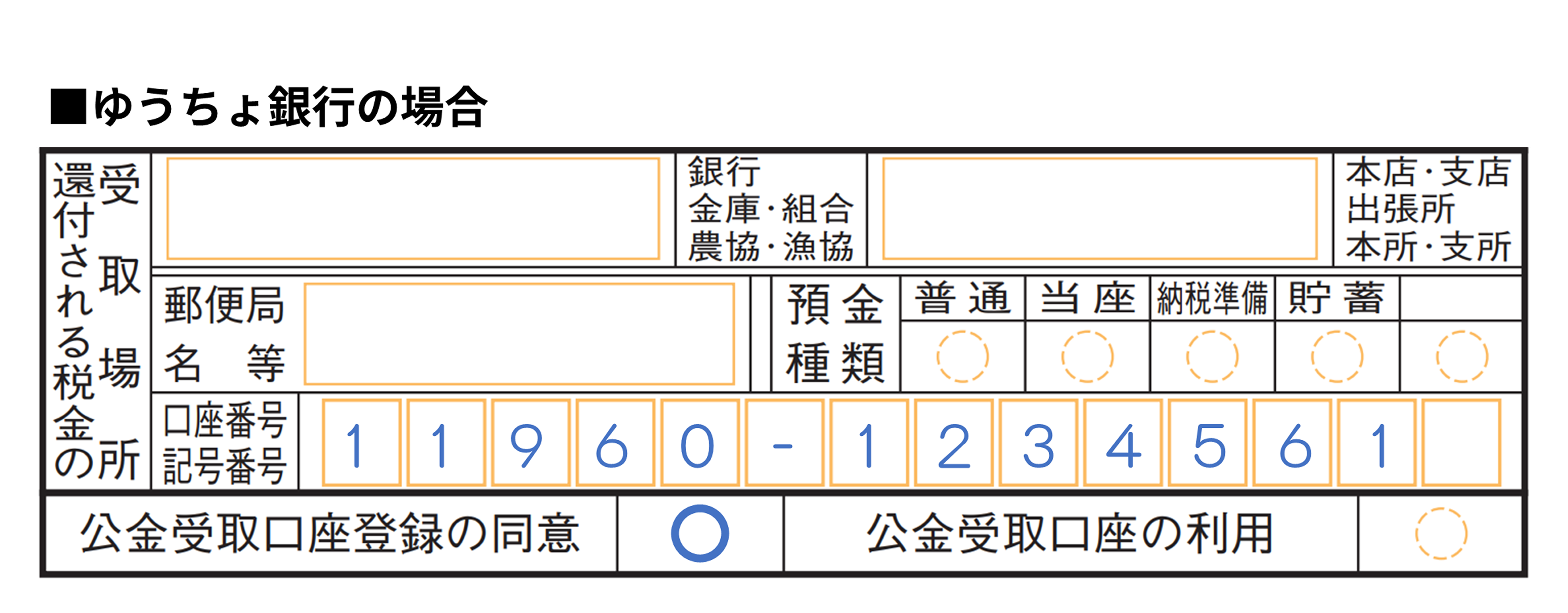

In the case of Japan Post Bank

- Name of financial institution: (Leave blank)

- Store Name: (Do not enter)

- Name of post office, etc.: (Leave blank)

- Type of deposit: (Leave blank)

- Symbol Number: (Example) 11960-1234561 (left aligned, no need for a digit between symbol numbers)

- Agreement of public money receiving account Registration: Enter a circle (○)

- Use of public money receiving account: (leave blank)

Related Information

- FAQs: Managing public money receiving account Registrations

- FAQs: public money receiving account Registration for Filing Income Tax Returns (Returns for Refunds) and Requesting Reassessment

- Forms and Guidelines for Tax Returns (National Tax Agency)

- Step 5 Register and Use public money receiving account (National Tax Agency)